Maui Vacation Rentals: Still a Smart Investment?

By Levi Jonathan Mizel

Maui Property Experts

Have you been thinking about buying a vacation rental property on Maui, maybe that oceanfront condo you’ve been dreaming about since your last visit? The location was perfect, and the rental income would help cover the cost.

But is a Maui vacation rental still a good investment in 2025? Well, grab your beach chair and a strong Mai Tai, because over the past few years, things have changed…

Reality Check: It’s Not All Sunshine and Rainbows

Let’s start with the not-so-sexy stuff.

First is income, in other words, your ability to rent the unit when you are not on the island. Rental income is important because it helps you defray the costs of owning the property, and even helps you qualify for a mortgage if you are not paying cash.

You may have heard of the Minatoya List, which is Maui County’s list of condos allowed to offer vacation-rentals in Apartment-Zoned complexes. Being on the list used to mean you were safe. But these days? Not so much.

With ongoing housing shortages due to the Lahaina fires, and potential regulatory changes, Minatoya List properties may well lose their ability to do short-term rentals if Maui County decides to tighten the rules, which looks to be likely.

That uncertainty has a lot of owners sweating right now, and it’s why we recommend clients purchase only in a Resort or Hotel-Zoned complexes, which are approved for short-term use.

That uncertainty has a lot of owners sweating right now, and it’s why we recommend clients purchase only in a Resort or Hotel-Zoned complexes, which are approved for short-term use.

Outside of zoning issues, many complexes are also dealing with insurance spikes. Thanks to a combo of wildfires, rising construction costs, and changes in weather patterns, insurance today costs more than it did a couple of years ago. That plus higher property maintenance costs leads to increased HOA fees.

And let’s talk about the buildings themselves. Many Maui condos were built back in the 70s and 80s, which often means deferred maintenance. There are roofs that need to be replaced, plumbing that needs to be upgraded, parking lots that need to be repaved, and buildings that need to be repainted, all contributing to increased costs, and sometimes leading to special assessments.

And don’t forget potentially lower visitor counts since the fires and Covid. With more vacation rental options on the market and fewer tourists, some lower-end units are sitting empty longer than their owners would like.

I don’t mean to burst your bubble, but I’d rather you know the truth before we get into escrow and you learn the facts. 🙂

The bottom line is that if you’re buying property on Maui thinking it’s going to be your golden goose, you might want to reconsider. When you factor in all the costs, maintenance, assessments, taxes, and fluctuating rental income, your actual return might not even beat a boring old index fund.

So why are people still buying on Maui?

You Can’t Watch the Sunset from an Index Fund!

The reason is simple, people buy here because they love the island and the unique Maui vibe. There’s a lot more to the story than dollars and cents.

That condo is not only an asset. It’s your front-row seat to humpback whales breaching at sunrise. It’s where your kids learn how to surf. Where you sip wine on the lanai and watch the sky turn pink and gold while holding the hand of someone you love.

It’s memories in the making, year after year, with the people you care  about most.

about most.

Family trips, playing in the waves, sandy towels draped over beach chairs, the smell of salt air mixed with sunscreen as you head off to explore a new restaurant or go on a whale watch.

Now, when walking down the beach with family and friends, remember this isn’t about real estate. It’s about creating new traditions with people you love.

It’s about giving your family time together in paradise, making memories that will last long after the sun has set.

Important Steps For Maui Property Buyers

If you love Maui and are thinking of buying property, it’s a great time. Inventory is up, prices are down, and we are officially in a buyer’s market.

Here are a few things to keep in mind…

- Consider a Resort or Hotel-zoned complex: First and foremost, if you are buying a vacation condo, consider the property's zoning. If you need the income from renting your condo or to qualify for a mortgage, you should be focusing on Resort or Hotel-zoned complexes, which will be rentable, even if the county decides to remove the Minatoya list exemption on apartment zoned properties.

- Focus on quality: Units with poor views, next to busy streets or elevators, in run-down areas, falling into the ocean, located on the first floor of buildings in flood zones, and with other deficiencies should be avoided. They might be cheaper, but understand your condo will not only be harder to rent, it will also be harder to sell when the time comes. You may pay more upfront for quality, however in the long run, you will appreciate having a beautiful vacation property when you are on the island, and having a unit that is in demand when you want to rent or sell.

- Check rental sites and reviews for the unit and complex: This one is critical, and almost nobody does it... Nearly every vacation rental is listed on VRBO, Airbnb, or rental site. Make sure to Google both the complex and the unit itself to see how actual guests feel about the condo you are considering. Pay attention to complaints about noise, deficiencies like low water pressure, problems with management, and other issues. Remember that even if you purchase the unit and completely upgrade it, those bad reviews will continue to be on Google until you establish your own history.

- Consider buying something that is already remodeled: Many people think they will be able to easily upgrade their unit after they buy it. Be aware that construction costs have skyrocketed on Maui and finding reliable contractors is very difficult right now. Many are working in the Lahaina fire zone rebuilding housing for residents. Not to mention that you won't be able to rent the unit while it is under construction, which can take 3 to 6 months depending on the scope of work.

- Review the financials carefully: If the condo is currently a vacation rental, you should be given income and expense information for a minimum of two years prior, even longer if possible. And per Hawaii law, you must be given a copy of the HOA documents, house rules, and recent decisions by the board regarding financials, assessments, deficiencies, or planned work within 3 days of going into escrow. If there's a large assessment, we recommend making sure your offer includes a stipulation that the assessment will be paid by the seller so you don't have a large bill after you purchase.

- Read property disclosures and get an inspection: Hawaii is a full disclosure state, which means that the seller must disclose anything and everything that may affect the value of the property. Make sure to review this document as soon as you receive it, even if your offer is on an "as is" basis. Definitely get an inspection from a qualified contractor of inspector so you know exactly what you are getting into. There's nothing worse than buying a property and needing to unexpectedly spend thousands of dollars before you move in.

- Hire a great agent: Although there are many excellent agents and teams here on Maui, there are also some that are not so great. Make sure your agent is familiar with the area and the complex, and they have experience with vacation rentals. The Maui Property Experts have years of experience, and we are part of Coldwell Banker, the largest brokerage in Hawaii.

Ready to Make Your Move? Let’s Talk...

If you’re interested in Maui Real Estate, whether for a family home, vacation condo, corporate retreat, or something else, I’ve put together a free South Maui Buyers Guide to help you get started. It’s packed with insider tips, property insights, and straight talk about what it’s like to own here, along with links to all South Maui Properties, which is our favorite part of the island.

Want a copy? Just click the button and I’ll send it right over. Because sometimes, the best investment isn’t about dollars and cents — it’s about sunsets and memories.

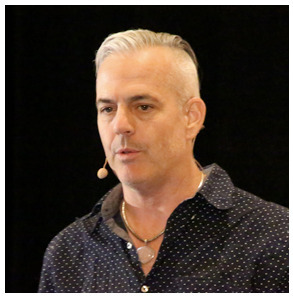

Meet Levi Jonathan Mizel, Your Realtor On Maui

Coldwell Banker is Hawaii’s number #1 brokerage and Levi Jonathan Mizel is a long-time Maui resident with extensive knowledge of the South Maui real-estate market and a ready supply of properties.

If you are thinking of buying a home or condominium on Maui, get your free Buyers Guide with detailed listings sorted by area, complex, and price. You may be surprised what you can afford.

Who Is Levi Jonathan Mizel?

Expert Market Knowledge

Levi has extensive knowledge of all available Maui properties, including recent closings, and price reductions. Let him be your guide to buying or selling for the best price on the Island of Maui.

23 Year Maui Resident

Levi is both easy-going and professional, offering friendly, high-touch service. His connections give him access to the best deals and his association with Coldwell means the it gets done correctly.

Long Time Investor

A property investor since 1989, Levi knows how to leverage time and resources. His local knowledge means he knows the best complexes and locations on the island for income and vacation use.